Top Term Insurance Advisors Near You With Reviews & Ratings

Grisha June 30, 2025 No Comments

Top Term Insurance Advisor In today’s uncertain world, term insurance is one of the smartest, most affordable ways to secure your family’s financial future. But choosing the right policy — and the right advisor — can be confusing. That’s why we’ve created a list of top-rated term insurance advisors near you — complete with reviews, ratings, and how to connect with them. Whether you’re looking for ₹1 crore coverage or a premium waiver plan, the right advisor makes all the difference. Why Use a Term Insurance Advisor? ✅ They compare policies from multiple insurers (LIC, HDFC Life, ICICI, etc.) ✅ Help choose plans based on age, income, liabilities ✅ Guide on riders (accident cover, critical illness) ✅ Handle paperwork and claims ✅ Explain tax benefits under Section 80C and 10(10D) Find Top Term Insurance Advisors in Your City City Top Advisors Avg. Rating Delhi LifeCoverPro Pvt. Ltd., Rahul Seth Advisors

Read MoreGold-Backed Loans Surge in India: Smart Financing Strategies 2025

Grisha June 28, 2025 No Comments

Gold-Backed Loans India 2025 | Smart Financing Tips In 2025, gold-backed loans in India are seeing explosive growth. As inflation rises and liquidity tightens, more Indians are turning to their gold to secure quick, hassle-free financing. Unlike unsecured personal loans, gold loans offer low interest rates, minimal documentation, and high approval speed — making them the smart choice for both households and small businesses. Why Gold Loans Are Booming in India in 2025 Gold has always been a trusted store of value in India. Now, it’s also becoming a preferred collateral asset for short-term financing. Here’s why: 💰 High liquidity: Loan disbursed in hours 📝 Minimal paperwork: PAN + ID proof = enough 📉 Lower interest rates than personal loans (as low as 8%) 🪙 Gold’s rising value means higher loan eligibility Best Gold Loan Providers in India (2025) Provider Interest Rate Max LTV Tenure Speed Muthoot Finance 9% –

Read MoreTop Business Loan Providers in India for Small Enterprises 2025 Guide

Grisha June 26, 2025 No Comments

Best Business Loan in India 2025 Small businesses are the backbone of India’s economy — but without access to credit, growth hits a wall. Whether you need capital to expand, purchase equipment, or manage cash flow, choosing the right business loan provider can make or break your momentum. Here’s your definitive guide to business loan providers in India, tailored for small and medium enterprises (SMEs) in 2025. Why Choosing the Right Loan Provider Matters Not all lenders are created equal. Factors like interest rates, loan amount, repayment flexibility, and collateral requirements vary dramatically. As a small business, you want a lender who understands your size, scale, and cash cycle. Top Business Loan Providers in India (2025) Provider Loan Amount Interest Rate (Avg) Processing Time Best For HDFC Bank ₹50,000 – ₹50 lakh 11.90% – 21.35% 3–7 days Retail/Service SMEs Bajaj Finserv ₹1 lakh – ₹45 lakh 17% – 28% 48

Read MoreTop 5 Credit Cards for Building Credit in 2025

Grisha April 26, 2025 No Comments

Top 5 Best Credit Cards for Building Credit in 2025 | Build Credit Fast Building a strong credit history is more important than ever in 2025. Whether you’re a student, a young professional, or someone rebuilding your credit, the right credit card can make a huge difference. Choosing the best credit card for building credit helps you establish a good payment history, improve your credit score, and access better financial opportunities in the future. If you’re wondering how to build credit fast this year, starting with the right card is key. Below are the Top 5 Credit Cards for Building Credit in 2025 — handpicked for their ease of approval, low fees, and credit-building benefits. 1. Discover it® Secured Credit Card Why it’s great: No annual fee Cashback rewards (rare for secured cards) Automatic review for unsecured upgrade after 7 months The Discover it® Secured Card is consistently rated among

Read MoreHow to Save Money Fast: 10 Proven Strategies for Financial Freedom

Grisha April 25, 2025 No Comments

How to Save Money Quickly – Financial Freedom Introduction In a world where expenses add up fast and financial freedom feels out of reach, learning how to save money quickly is more important than ever. Whether you’re building an emergency fund, paying down debt, or saving for a goal, these 10 proven strategies will help you take control of your finances and start saving today. 1. Track Every Dollar The first step in saving money fast is knowing where it’s going. Use a budgeting app or a simple spreadsheet to log your income and every expense for 30 days. This helps identify spending leaks and areas to cut back. Pro Tip: Review your subscriptions, impulse purchases, and eating out habits—they’re often the easiest to reduce. 2. Set SMART Savings Goals Set Specific, Measurable, Achievable, Relevant, and Time-bound goals. Clear goals help maintain focus and motivation. Example: “Save $500 in 30

Read MoreUnion Budget 2024 | Budget Expectations Vs Reality in India

Grow July 20, 2024 No Comments

Budget Expectations Vs Reality in India As we know that Budget 2024 Expectations in India the Union Budget 2024 approaches, anticipation is building across India. This annual financial statement, presented by the Government of India, outlines the nation’s revenue and expenditure for the upcoming fiscal year. With the country recovering from the impacts of the COVID-19 pandemic and navigating global economic uncertainties, the budget is expected to strike a balance between fiscal prudence and growth-oriented measures. Economic Overview and Fiscal Strategy Current Economic Scenario The Indian economy has shown resilience, with GDP growth rebounding and key indicators such as inflation and employment rates stabilizing. However, challenges like high inflation and fiscal deficits persist, necessitating a strategic approach in the Union Budget 2024. The government’s fiscal strategy will likely focus on maintaining a manageable fiscal deficit while promoting economic growth and stability. Revenue Generation and Tax Reforms Taxation reforms are anticipated

Read MoreHow to Earn Money From Affiliate Marketing

Grow May 7, 2024 No Comments

Earn Money From Affiliate Marketing While Learning (Step by Step) How To Earn Money From Affiliate Marketing while learning from home just using your smartphone. Here we are going to discuss in details, Let’s find out what is affiliate marketing? CLICK HERE TO START EARNINGS NOW What is Affiliate Marketing? Affiliate marketing is the process by which an affiliate earns a commission for marketing another person’s or company’s products. The affiliate simply searches for a product they enjoy, then promotes that product and earns a piece of the profit from each sale they make. Who Can Start Affiliate Marketing? The essential requirements (smartphone, willing to learn new things) for joining any affiliate program are simple, anyone can start affiliate marketing but below person can be succeeded. Schooling Going Students – Distance or Regular Mode – You can earn your pocket money from here. College pursing students – Both Distance or Regular

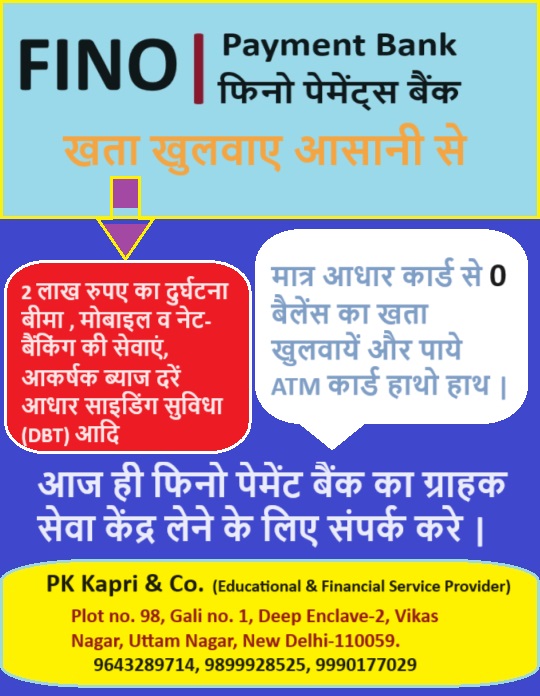

Read MoreFino Payments Bank Types Accounts Available

Grow March 13, 2024 No Comments

Online Fino Bank Limited Types Accounts Opening Fino Payments Bank Types Accounts Available. Dear Fino Payments Bank ltd user as we know there are different types of saving and current accounts available. Here we have described in details. Fino Payments Bank Ltd CSP (Customer Service Points) Provider Call Now to Get CSP ID of FINO Bank – 9643289714. Fino Payments Bank Ltd CSP (Customer Service Points) Dear Fino Payments Bank (Fino Bank) customer you can avail following services here – Account Opening Saving Accounts: – Shubh Saving Account – Zero Balance Saving Account ones can open here and get fino bank ATM Card hand to hand age 18years & above. Bhavishaya Saving Account – This account special for school going student or children account age between 10year to 17years. This is zero balance account to get benefits for DBT form government scheme and others. Here one can open account and

Read MoreMost Profitable Business Idea After Corona Virus

Grow May 28, 2022 No Comments

Everyone Need To Know ! What Type of Business Should Start After Pandemic? Looking for a great Most Profitable Business Idea After Corona Virus? Read on for ideas that will help you start and grow a successful business in 2022-2023. Many of the best small business ideas for 2023 involve an online business model. Choose a business idea that you are knowledgeable and passionate about and develop a detailed business plan. Before starting a business, determine if there is a demand for the product or service you want to provide. This article is for anyone looking for inspiration to start a business. You want to start a business, but you’re having a tough time articulating your idea. If you want to become an entrepreneur, you need inspiration. It all starts with an idea that has room to grow over time. Some Most Profitable Business Idea After Corona Virus are :

Read MoreFino Payment Bank Ltd Distributor 9899928525

Grow April 24, 2022 No Comments

Fino Payment Bank Ltd Business Correspondence (BC) @ 9899928525 Become Fino Payment Bank Ltd Distributor 9899928525. Fino Payments Bank gives you the opportunity of making your business establishment into a bank branch, enabling you to act as a banker in your neighborhood. By being a part of Fino Payments Bank’s network you will be able to provide your customers all the services of a bank branch and also offer additional services such as travel bookings and bill payments amongst others. What Can Do One BC or CSP of Fino Payment Bank?? Domestic Money Transfers International Money Transfer Account Opening be it Current or Savings Account Aadhaar Enabled Payment System (AePS) Cash at Point of (Sale POS) Bill Payments Mobile / DTH Recharge Cash Management Services (For Multiple Clients) Travel Bookings (Be it for air travel/ rail travel/ hotel accommodation) Eligibility And Documents Required Age: 18 years and above Area of

Read More